Sustainable investment

WindShareFund IV ClimateBonds are climate bonds that allow you to invest in high-quality wind turbines. This combines a profitable investment with your personal contribution to the transition to sustainable, green energy.

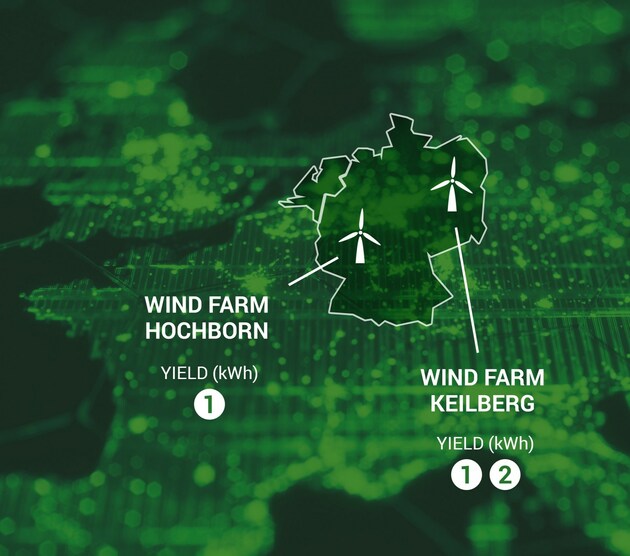

When you participate in ClimateBonds, you are granting a loan to WindShareFund Europe N.V. WindShareFund Europe N.V. will combine the proceeds of the ClimateBonds issue with bank loans to invest in several onshore wind turbines in Germany. You will receive a 3% base interest rate per annum over a maximum period of 10 years. The total return may be increased subsequently due to potential profit-sharing at the end of the term. ClimateBonds are available for €1,000 each.

The information on this website is deemed to be advertising. The prospectus contains detailed information about ClimateBonds; the information on this website has been simplified. Potential investors should read the prospectus with a view to fully understanding the potential risks and benefits. The prospectus can be downloaded under ‘Prospectus Review’.

Yes, I am now requesting more information without obligation about ClimateBonds

About ClimateBonds

Sensible investment

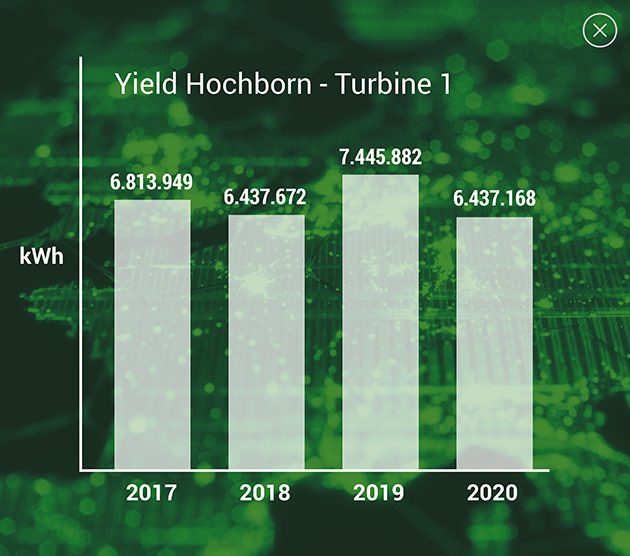

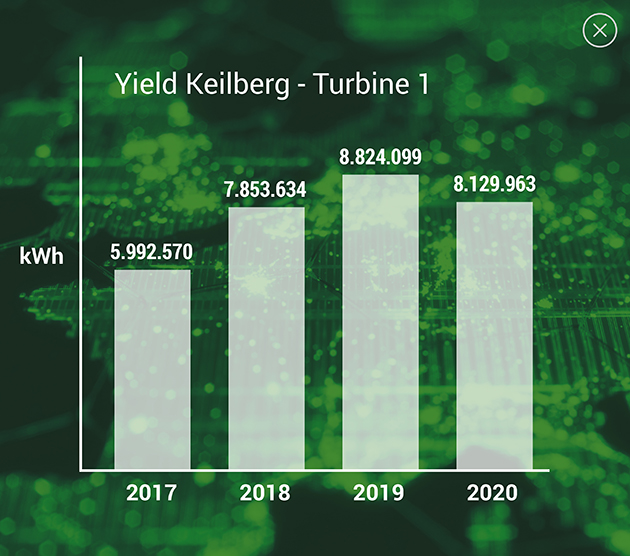

The ‘Energiewende’ (energy transition) is an important item on the German political agenda. By 2050, at least 80% of Germany’s electricity needs will be covered by renewable energy. Wind energy plays a major role in this transition. To promote this process, energy legislation described in the Erneuerbare Energien Gesetz (EEG) guarantees fixed offtake prices and the compulsory purchase of renewable energy by energy companies. In our opinion, this makes the German wind energy market a stable investment climate. We select high-quality wind turbines and invest your capital only in functioning wind turbines that are already connected to the electricity grid.

Sustainable Development Goals

Team

WindShareFund has been offering ClimateBonds since 2015. With an experienced team of professionals and solid business partners, 4 investment funds have already been successfully launched in the market.

WindShareFund Foundation

Parties Involved

About wind energy

Transition to sustainable energy

Most energy generation is based on the use of scarce fossil fuels that are being depleted. This is extremely harmful to the environment. In addition, Europe is 50% dependent on imports of these polluting fossil fuels, some from politically unstable regions. A transition to sustainable energy must be made in order to safeguard future energy needs.

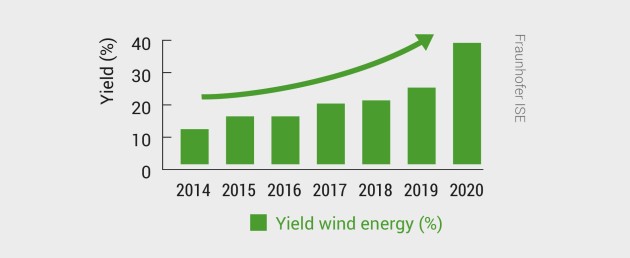

Renewable energy markets are on the rise

Wind energy is a proven, dependable technology. This is the cleanest and best option for reducing CO2 emissions. Wind turbines are becoming more and more efficient and profitable while costs continue to fall. Globally, the transition to sustainable, green energy is increasingly seen as a necessity. There is a clear upward trend in the market development of renewable energy, which will continue to increase in the coming decades.